We are thrilled to announce another update of the Wyden software. This latest release introduces exciting new features and enhanced functionality.

At the top of the list, Wyden is the first crypto trading platform to support OKX Nitro Spreads. Additionally support for new trading venues has been added as well. Wyden can now connect to the Hyphe, ByBit and Rulematch.

The new Wyden Exchange Simulator now enables users to submit simulated orders from the Wyden trading platform in the same fashion as real orders while in trading live mode.

Additionally, discounted fee functionality has been added to the Broker Desk.

Finally, the REST API documentation has been rewritten and reformatted. Additional code samples in an improved layout make it easier to find information.

Read further to get better acquainted with Wyden 6.6.

Support for OKX Nitro Spreads

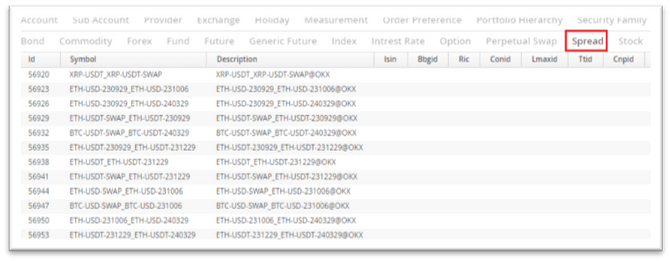

Wyden is the first crypto trading platform to support OKX Nitro Spreads, an offering that simplifies spread trading of crypto assets. Buying and selling Nitro Spreads is as easy as trading any other financial instrument. Nitro Spreads reference data can be downloaded from OKX with Wyden’s Reference Data Manager making the instruments available in Wyden.

Nitro Spreads are spread instruments with two constituents, or legs. Instead of opening two positions separately, as is typically the case, a trader places a spread trade with a single order on a single instrument. The system then creates or updates positions for each of the two legs simultaneously. This eliminates leg risk and reduces price slippage.

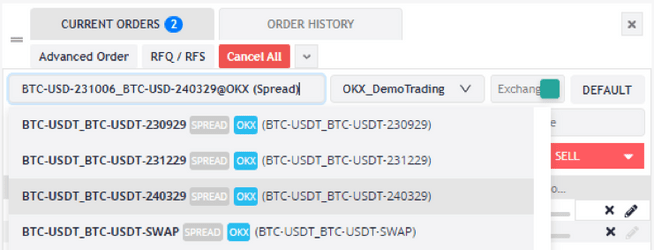

To create an order, a user selects the Nitro Spread from the drop-down list on the ‘CURRENT ORDERS’ tab.

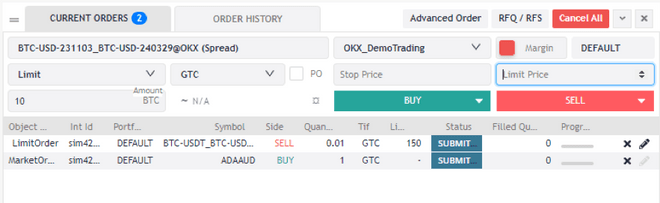

The user can then send the order as with any other trading instrument.

Both OKX Live and OKX Demo Trading are supported.

The Reference Data Manager downloads and stores reference data for all available Nitro Spreads. These data is then accessible through the Reference Data Manager similar to any other financial instrument.

Additional Trading Venues

Connectors to the following trading venues are now available in Wyden:

- Hyphe is a market maker and liquidity provider based in the Netherlands. Hyphe holds a BaFin license to offer their services in Germany. This license enables Hyphe to provide cryptocurrency trading services in Germany.

- ByBit is a cryptocurrency exchange based in Dubai. ByBit supports spot and margin crypto trading as well as crypto derivatives trading. ByBit also offers crypto term deposits and savings accounts, and it allows customers to lend and borrow crypto assets.

- Rulematch is a trading venue based in Switzerland focused primarily on banks. Using Nasdaq technology, Rulematch’s unique selling proposition is the ultra-fast execution of trades. Settlement of trades takes place between participants directly. Participant funds are never pooled with Rulematch.

Wyden Exchange Simulator

The Wyden Exchange Simulator enables simulated trading while the system is in live trading mode. It is no longer necessary to switch to simulation mode to test trading functionality. The new Exchange Simulator can even be used in combination with external trading venue connectors.

The diagram below shows how this works in practice:

From the Wyden dashboard, a trader simply selects the Exchange Simulator as the trading venue when sending an order. The order is then forwarded to the exchange simulator where, depending on current market conditions, it will be executed.

Improved REST API Documentation

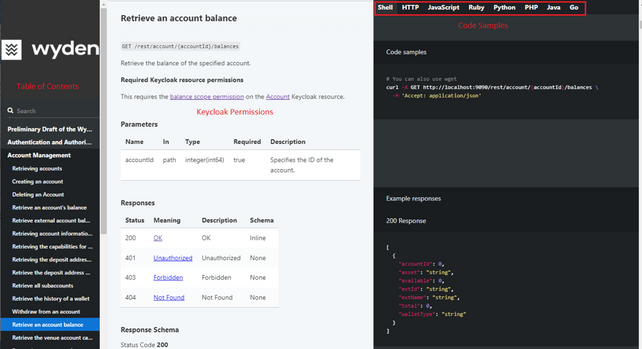

The Wyden REST API documentation now uses Slate, an industry leading API documentation tool.

For each of the REST endpoints, coding samples in several languages are provided, including Python, Java, JavaScript or Go.

All REST endpoint descriptions have been re-written, including descriptions of required permissions, payloads, and responses per endpoint.

Additional New Features

Fixed Fee Discounts on Broker Desk

An organization that uses Wyden’s Broker Desk can now specify – and subsequently offer – discounts on fees. This makes it possible, for example, to offer fee discounts on special occasions such as a customer’s first order, birthday, the first-year anniversary, and many others. These discounts can be defined with properties that have been added to the Synthetic account.

Improvements to Binance and TDX Connectors

Rate limits of the Binance Global connector can now be set for the connector itself and for individual accounts using the connector. The FOK trading option has been added to market orders for the TDX connector and is now set as the default Time-In-Force value.