We are pleased to announce the release of AlgoTrader 6.1.

Over the past few months, we have put a tremendous amount of effort into adding new functionality and connectivity options to further increase the benefits and value for institutional trading firms and banks requiring a state-of-the-art quantitative trading and order execution system.

Below please find a summary of all of the latest features and adapters that are now available in AlgoTrader.

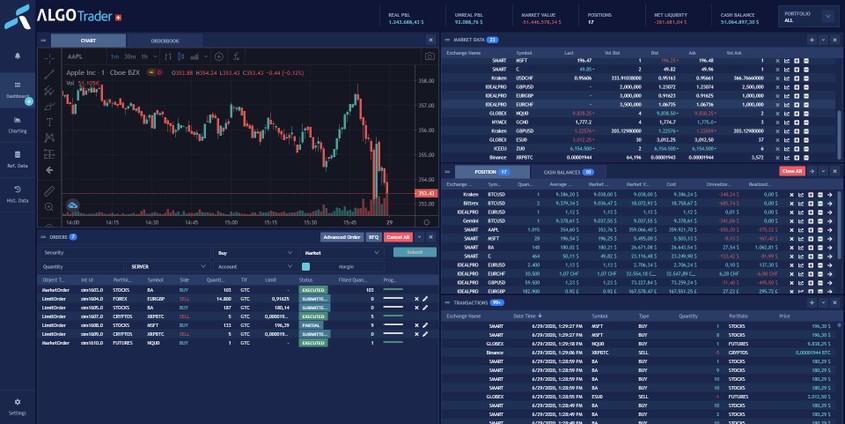

Fully redesigned User Interface

We have completely redesigned the AlgoTrader UI with a brand-new look & feel.

The new UI now supports multiple workspaces and a customizable widget system that allows you to add, remove, re-arrange and re-size individual widgets. For example, you can now arrange multiple charts in one workspace and use it for research purposes.

We have also introduced several minor ergonomic improvements like the pre-filling of fields and navigation using hotkeys.

In addition, we have introduced a mobile view that is available on both mobile phones and tablets to monitor the AlgoTrader system.

New Adapters

AlgoTrader now includes the following new adapters to exchanges, market makers and data providers.

- Refinitiv Elektron is a cross-asset real-time, reference, end-of-day, time series, and alternative data feed for FX, equities, indices, commodities, derivatives, and OTC.

- Bloomberg Tradebook the agency broker of Bloomberg L.P. provides access to global trading venues, proprietary trading algorithms as well as pre-and-post trade analytics. It provides direct market access (DMA) to more than 110 markets across 44 countries.

- Gemini the regulated New York State based cryptocurrency exchange, wallet, and custodian that was founded in 2014, by the Winklevoss brothers.

- LMAX Digital a regulated institutional spot crypto currency exchange based on proven and proprietary technology from LMAX Group. LMAX Digital holds a license from the Gibraltar Financial Services Commission.

- Bittrex a US-based cryptocurrency exchange headquartered in Seattle serving US clients. Bittrex Global is a Liechtenstein based subsidiary of Bittrex serving non-US clients.

- eToroX eToro’s crypto exchange, offers crypto asset trading to algo traders, institutional-grade investors, and seasoned crypto traders.

- Blockfills an electronic, off exchange, digital liquidity provider operating using an electronic communication network model (“ECN”).

- Crypto Broker a Swiss financial intermediary that enables participation for institutional clients and financial intermediaries in the emerging digital asset class.

- Enigma Securities a leading facilitator for crypto currency liquidity and custody offering a proprietary electronic trading platform.

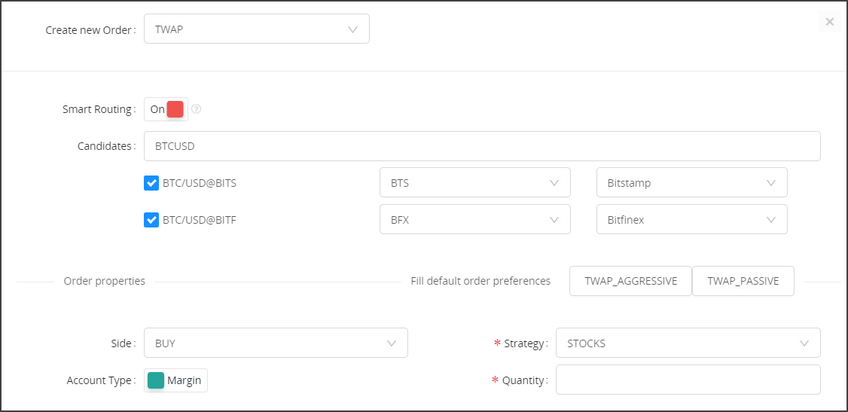

Execution Algo & Smart Order Routing UI

After releasing the first version of the Execution Algo UI in 5.0, we have in the meantime completely redesigned the Execution Algo & Smart Order Routing UI to make it more intuitive and user friendly.

This new Smart Order Routing UI is now available for both Execution Algos (which split up large orders into smaller ones) as well as Simple Orders (such as Market Orders and Limit Orders).

New REST API

The full functionality of the system is now available via our REST API. This new API includes many new and useful endpoints like:

- Rate Limit endpoint allows you to consistently monitor the number of calls available against the often quite restrictive crypto-exchange rate limits.

- Health Check endpoint returns live information regarding the state of the system, including connectivity information about each of the configured exchange.

- New Marketdata subscription endpoint allows fine-grained configuration of your market data streams including top-of-book and full order book and even aggregated order book market data subscription.

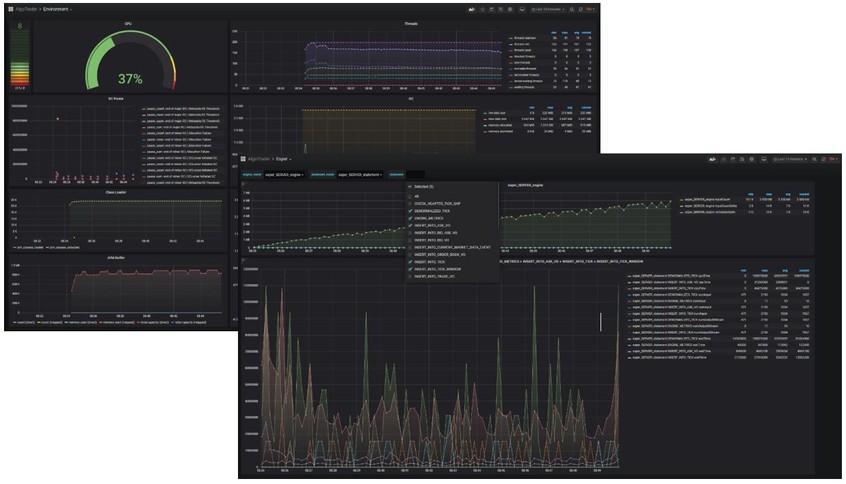

System Monitoring

We have added an extensive suite of tools that allow monitoring of the entire system

- The performance of various AlgoTrader components and processes like Market Data Metrics, Order Metrics, Tick-to-Trade Metrics, Esper Engine Metrics, Hazelcast Metrics, and Influx Metrics to give you detailed insights on the performance of various AlgoTrader sub-systems.

- Monitoring of the health-state of various AlgoTrader components like adapters, database, Hazelcast caches, and JVM. The health state of these components is also available via API.

- General system metrics like memory consumption, CPU usage, JDBC connections, SQL queries, and HTTP calls.

New Example Strategies

- Market Maker – This strategy uses a mean-reversion model to calculate the theoretical mid-price and will then place bid/ask orders around this theoretical mid-price.

- Relative Strength Index (RSI) – This example strategy shows how the relative strength index can be used to predict market moves and generate buy or sell orders accordingly.

Additional minor new features

In addition, we have also added the following useful features:

- Full Order Book Support during Back Tests. For this, we have introduced a new event type called OrderBookVO that will be used to disseminate order book data to quantitative trading strategies during back test. It is even possible to subscribe for top-of-book or full-order-book on an instrument by instrument basis.

- The Inbound FIX API now also fully supports execution algo orders including all properties that can be configured through custom FIX tags

- We have updated the Fee Handling Functionality that now allows clients to configure fees not only on a per-security-basis, but even down to individual orders. Client specific fee data such as fee-tiers can be used to influence routing decision of the Smart Order Router. Fee information will also be incorporated into the P&L calculations.