We are pleased to announce the release of AlgoTrader 6.2

We are constantly working to make AlgoTrader a more versatile and efficient trading experience. The latest release provides improvements throughout your trading workflow, bringing you improved visualizations, increased connectivity and new execution algorithms. Here are the highlights at a glance:

- Beautiful trading data and performance visualizations

- Binance Futures, Poloniex spot, and German stockbroker Sino

- A new identity and access management system

- A radically improved API key management system

- 4 brand-new, off-the-shelf execution algorithms

- Simultaneous trading of multiple accounts on the same exchanges

…and much more! See below to find out what else we have built for you and stay tuned for the killer features we are going to release in AlgoTrader 6.3!

Trading Data and Performance Visualizations

AlgoTrader now includes the following new visualization capabilities based on InfluxDB and Grafana.

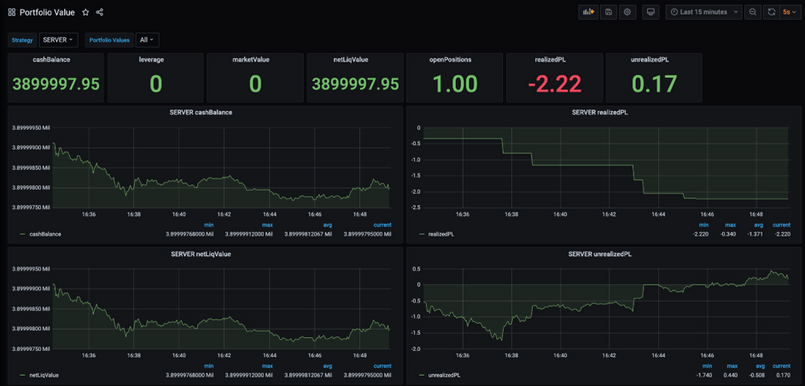

- Portfolio Value dashboard: This new dashboard visualizes performance-related metrics such as realized and unrealized profit-and-loss, cash balance, net liquidation value, and open positions, among others in real time.

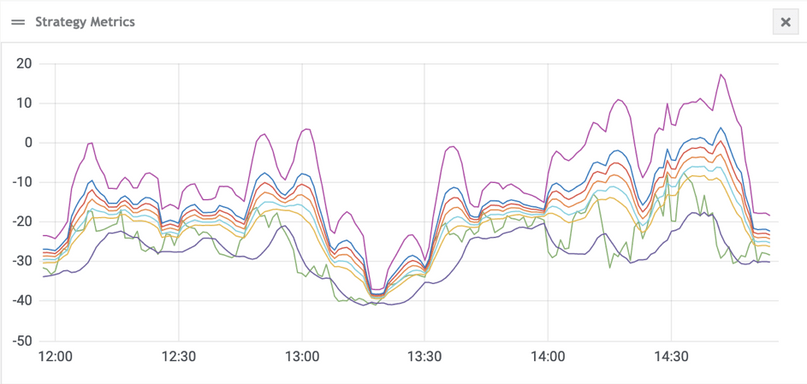

- Custom metrics visualization: Any type of time series-based data can now be recorded using InfluxDB and visualized using Grafana. This can for example be utilized for quantitative trading strategies to visualize strategy metrics over time. Or it can be used to visualize time-series data retrieved from external sources (e.g. company fundamentals).

New Adapters

AlgoTrader now includes the following new adapters to exchanges, market makers and data providers:

- BINANCE FUTURES: In addition to crypto spot trading on Binance, AlgoTrader now has full support for trading crypto derivatives on Binance, including futures and perpetual swaps.

- Poloniex: Poloniex is a US-based digital asset exchange, with crypto spot trading now supported through AlgoTrader. Since 2018 Poloniex is owned by Circle.

- Sino: Sino is an institutional brokerage firm supporting international and German stock exchanges.

Flexible venue updates

All venue adapters are now managed as individual and independent components that can be deployed into the AlgoTrader system. This allows for venue adapters to have separate life cycles and be released independently of the main AlgoTrader system.

New Identity and Access Management

AlgoTrader now integrates Keycloak, an open-source Identity and Access Management platform managed by Red Hat.

Keycloak offers features such as single-sign-on (SSO), identity brokering and social login, user federation, client adapters, an admin console, and an account management console.

Here are some of the benefits

- With the integration of Keycloak, AlgoTrader now delegates most of the security-related functionality to Keycloak

- Keycloak now handle all user logins. The login functionality is highly customizable and includes features like email confirmation, password resets and two-factor authentication (using Google Authenticator). In addition, it supports password policies and custom login flows.

- Users/groups/roles can be synchronized with an LDAP or Active Directory server

- It also allows user signups through Google, Facebook, LinkedIn, GitHub, etc.

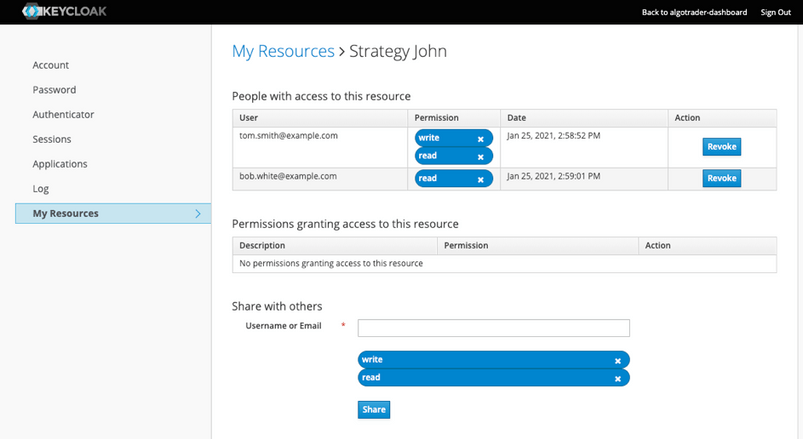

- Keycloak also comes with an account management console where users can modify their profile settings, passwords and see their session data. This account management console also allows you to assign owners to individual resources. A resource could be for example an AlgoTrader portfolio or an AlgoTrader account. The user can even share resources with others through the account management console.

- Keycloak comes with an authorization service that can be used to define fine-grained permissions on individual resources (e.g. an AlgoTrader portfolio or an AlgoTrader account) or resource scopes (e.g. trading a particular portfolio, sending orders for a particular account).

- All authorization capabilities are extremely flexible and support users, groups (even group hierarchies), roles (including composite roles), policies, permissions, etc. With these capabilities, authorizations can be configured in a very flexible way. For example, a trader may only be permitted to access his own portfolio, or a risk manager may be authorized to see all system information but not to place any orders, while an admin may be granted permission to assign members to his team.

- Keycloak runs as a separate Docker container that we can deploy alongside AlgoTrader.

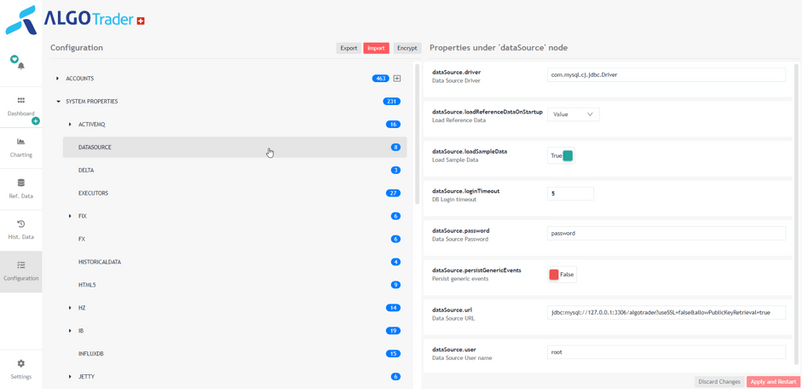

Browser-based UI configuration

The entire system functionality can now be configured through a browser-based front end. This includes system configurations such as database connectivity, network ports, and trading and execution-related settings. In addition, all venue adapters can be configured through the new user interface. The user interface contains convenient functions to import and export entire system configurations and also allows for encryption of sensitive data such as passwords and external API keys.

In addition, the management of API keys has been re-engineered from the ground up to increase overall system security. AlgoTrader now also includes a UI-based key management system where API keys can be generated and managed. Generated API keys can be used both with the REST/Websocket interface as well as the FIX interface.

Multi Account Support

AlgoTrader now offers full multi-account support which includes both of the following use cases:

- Venues that support multiple sub-accounts (using the same API keys for all sub-accounts)

- Venues that do not support sub-accounts (using different API keys for multiple accounts)

New Execution Algos

We have extended the selection of ready-made execution algorithms to include the following:

- Market Sweep : This algo order identifies the current best top-of-book price and submits the corresponding part of the algo order for immediate execution.

- Sniper: This algo scans the opposite side of the market. If there is at least one ask (bid) available at or below (above) the specified limit price, a child limit order is submitted.

- Percentage of Volume: This algo is based on volume and tries to minimize the impact on the market price. The execution time window of the algo is divided into smaller time windows. At the end of each time window the algo submits a child order with a quantity equal to the specified volume participation of the previous time window.

- Iceberg: This algo divides large order quantities into smaller child limit orders, for the purpose of hiding the overall order quantity. This algo submits only the specified part of its total quantity to the venue. Whenever a child order gets filled, a subsequent child order is sent to the venue.

These algorithms allow our clients to adapt to market situations and get the best possible execution price on orders of any size.

Extended Inbound FIX Interface

The existing inbound FIX interface has been extended with the following capabilities:

- RFQ: support for full RFQ (request for quote) trade flow with OTC brokers and market makers.

- Market Data: support for top-of-book as well as full-order-book market data.

- Algo Orders: All algo orders are now available through the FIX interface in addition to simple orders like market and limit orders.

New Example Strategies

- EMA Kotlin: The AlgoTrader sample strategies now include a Kotlin version of our EMA (Exponential Moving Average) strategy

Extended Bond Trading Capabilities

The AlgoTrader bond trading capabilities have been extended with the following functions:

- DV01 Calculation: The DV01 / Bond dollar duration measures the dollar change in a bond’s value to a change in the market interest rate.

- Nelson-Siegel interpolation: The Nelson‐Siegel model is widely used in practice for fitting the term structure of interest rates.

In addition, AlgoTrader Bond entity has been extended with the following attributes:

- Coupon Frequency

- Bond Rating (Moody’s, Fitch)

Additional minor new features

In addition, we have also added the following useful features:

- Java 11 support: This allows quantitative strategy developers to take advantage of all the new Java 11 language features including Reactive programming as well increased performance and security.

- Generic events extension: it is now possible to download all known Interactive Brokers generic events as well as all known Intrinio events.