With this release, we introduce AlgoTrader Broker Desk, an exciting new feature that enables agency and principal trading through AlgoTrader. Now you will be able to offer crypto & digital asset trading to your customers while monitoring your risks and generating new revenue streams!

Institutional trading firms need to stay on top of their trading activities at all times. With this release – from order placement to trade monitoring and risk management – we’ve got you covered!

We have enhanced AlgoTrader’s ability to manage and monitor risks with alerts, checks and an improved dashboard.

Last but not least, AlgoTrader now supports several additional trading venues – including Galaxy Digital, Cumberland and dYdX, the first decentralized exchange (DEX).

So, let’s take a look.

Broker Desk for Agency & Principal Trading

An increasing number of financial institutions are starting to offer digital asset trading to their clients from a web portal, eBanking or a mobile app. And they’re choosing AlgoTrader to make this happen.

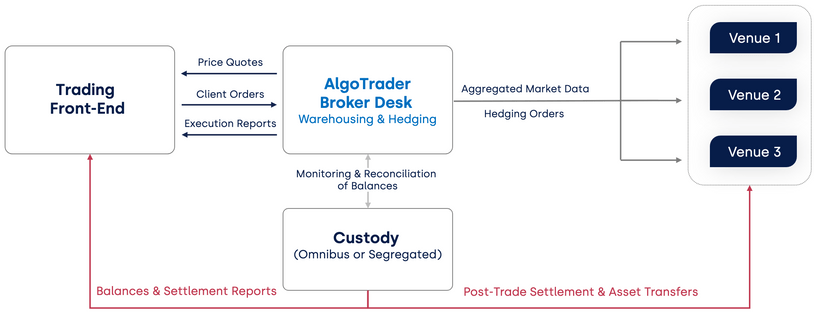

This is thanks to the AlgoTrader Broker Desk, a new, powerful feature that enables sell-side firms to generate new revenue streams and monitor associated risks with full control. Broker Desk lets sell-side trading firms configure the fee schedules to be applied to customer order flow. In addition, warehousing of client positions and automated hedging of market exposure is now supported by the system.

AlgoTrader Broker Desk works seamlessly with AlgoTrader’s Smart Order Routing (SOR) to provide clients with the most competitive price available in the market at the lowest cost and risk.

Have a look at the full list of AlgoTrader business features.

New Connectors

First Connector to a Decentralized Exchange – dYdX

In a pioneering step, we have partnered with the decentralized exchange dYdX , thereby being the first order & execution management system vendor to offer derivatives trading through a decentralized exchange (DEX).

AlgoTrader’s institutional buy- and sell-side clients benefit from the dYdX partnership due to increased liquidity, instant trade execution with on-chain settlement, zero gas fees, minimized trading fees, and broad access to perpetual contracts – resulting in cost-efficient leveraged trading.

Given dYdX is a non-custodial decentralized exchange, institutional clients retain full control of their assets – accessible at any time through AlgoTrader’s convenient user interface. This goes hand in hand with improved pricing accuracy due to decentralized on-chain oracles which reduce counterparty risk.

Read the official AlgoTrader dYdX press release.

Additional New Connectors

AlgoTrader now includes the following new connectors:

- Galaxy Digital is a technology-driven financial services and investment management firm that provides institutions and direct clients with a full suite of financial solutions spanning the digital assets ecosystem.

- Cumberland is one of the world’s leading liquidity providers in crypto assets. Cumberland DRW LLC provides institutions and individuals with unique access to opportunities in the crypto asset space. Cumberland provides a streamlined and efficient counterparty onboarding process with physical, electronic and procedural safeguards that keep information safe from unauthorized access or use.

For further details please see the full list of AlgoTrader Connectors.

Connector extensions

Various new features have been added to the existing list of connectors, including Margin Trading and Post Only Order capability.

For further details please see the full list of AlgoTrader Order Management features.

New Risk Workspace

Configurable pre-trade checks

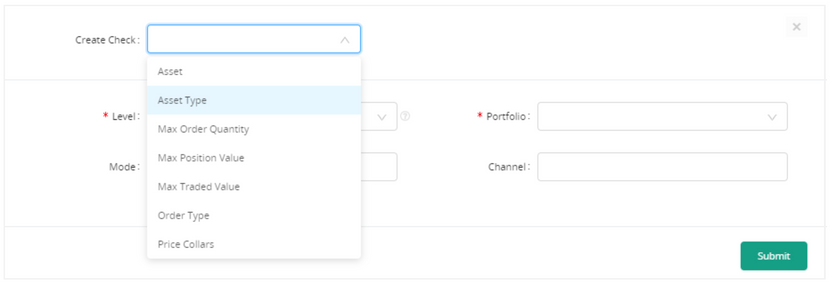

AlgoTrader now supports pre-trade checks for manual trading, API trading and quantitative trading strategies. While this functionality was previously available via the AlgoTrader API only, fully customizable pre-trade risk rules can now be configured through the newly introduced Risk Workspace.

For example, different types of rules can be defined to control

- whether an asset or asset type may be traded

- whether an order type is permitted

- the maximum order quantity or value

- the maximum market exposure of an individual position

Configurable post-trade action

In addition to the existing standard order validations, it is now possible to configure actions to be performed after an order has been executed. Configurable post-trade actions can be used in many ways, such as to:

- allocate trades to specific portfolios

- trigger post-trade settlement

- automate a custom trade flow

Have a look at the full list of AlgoTrader Pre-Trade and Post-Trade Capabilities.

Trading Kill Switch

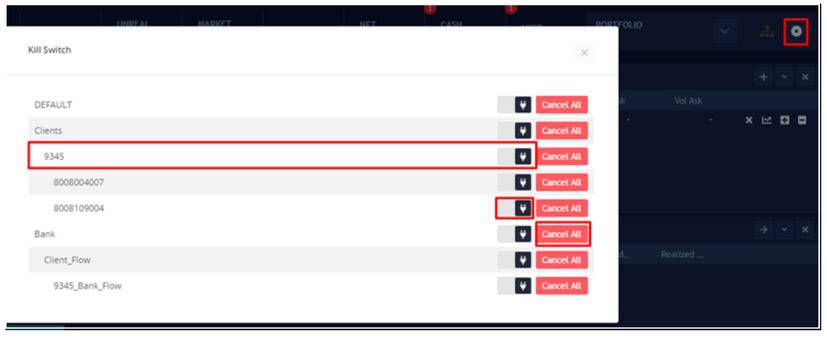

AlgoTrader’s kill switch functionality allows traders to stop API trading immediately if market conditions require it.

A trader can pull the plug for one or many portfolios at the same time. If, for example, a parent portfolio is deactivated, all its child portfolios are also automatically deactivated.

In addition, AlgoTrader now also offers the option to cancel all open orders of a portfolio.

Dashboard Improvements

Support for post-only orders

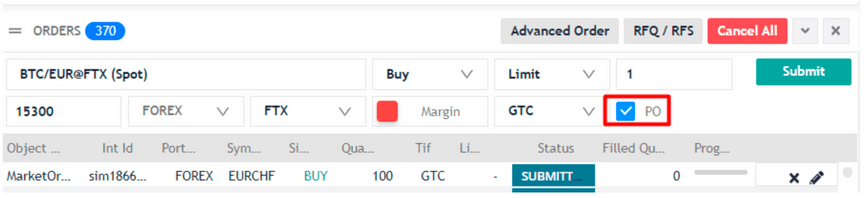

Available as an additional option for limit orders, post-only serves to ensure that an order will be put on the order book of the selected venue without being matched to any existing order. A post-only order provides liquidity to the venue through a maker order. Fees charged for maker orders are generally less than those charged for a taker order. When this option is selected, the exchange will automatically cancel the limit order, if the order would be executed immediately upon order placement.

This option can be selected via the “PO” check box, which is available for certain venues that support post-only orders.

Have a look at all the other capabilities of the AlgoTrader User Interface.

Virtual spot positions

In AlgoTrader, cryptocurrencies are generally considered the same way as Forex instruments. This means that, by default, any spot crypto positions are treated as cash balance holdings. This also means that, by default, a trader will not be able to track the performance of a spot crypto position over time.

Fortunately, AlgoTrader now lets you view a spot crypto position as a Virtual Spot Position. A Virtual Spot Position lets you visualize a holding in cash or crypto spot as a virtual position. If the position is subsequently increased or decreased, the virtual position will, in turn, increase or decrease.

After virtual spot positions have been enabled, AlgoTrader will display any subsequent buy or sell of cryptocurrencies on a spot market as virtual spot positions. All portfolio metrics that apply to margin positions will apply to the virtual spot position as well.

The screenshot below displays two ADA/BTC positions, one virtual, the other a regular margin position. Both were bought on the crypto exchange Kraken, one as a spot order and one as a margin order. The position that resulted from the spot trade has type “Virtual” while the other has type “Margin”.

Have a look at all the other features of the AlgoTrader Order Management.

Custody Integration

Metaco Integration

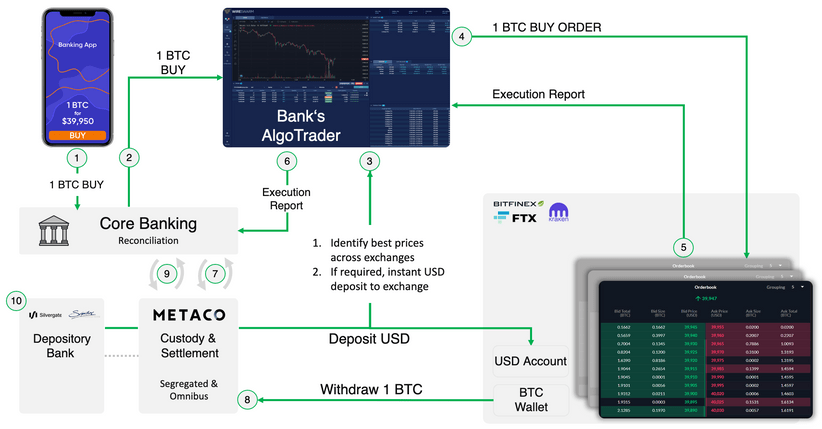

Metaco is a digital asset custody platform enabling businesses to secure, issue and manage digital assets. The AlgoTrader Metaco connector provides access to account balances from all Metaco accounts / wallets. It also enables transfer of assets between these Metaco wallets and outside wallets.

The diagram below illustrates a typical banking use case where AlgoTrader is integrated with the Metaco custody platform. This configuration orchestrates the end-to-end trading lifecycle from order placement, through venue selection and pre-funding to trade execution and then to custody, settlement, and core banking integration.

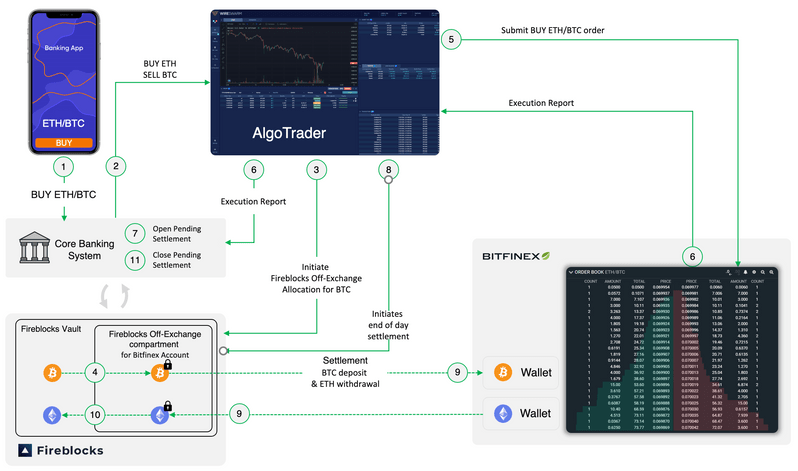

Fireblocks Off-exchange settlement

AlgoTrader now integrates the Fireblocks off-exchange settlement, which removes the need for pre-funding when executing orders on crypto exchanges.

To demonstrate this capability a Straight-Through-Processing (STP) workflow was implemented in collaboration with Fireblocks and Bitfinex, which includes the following steps:

- A client order is routed from the Core Banking System to AlgoTrader.

- AlgoTrader invokes an off-exchange allocation through Fireblocks to instantly pre-fund the Bitfinex exchange account.

- Once the off-exchange allocation completes, AlgoTrader executes the client order.

- Upon order execution, AlgoTrader sends the execution report to the Core Banking System which opens a pending settlement position signifying that the client order has now been executed but not yet settled.

- Once a day or upon request AlgoTrader initiates the post-trade settlement (on-chain) between the Bitfinex account and Fireblocks.

- Upon completion of the post trade settlement, the pending settlement position in the Core Banking System is closed.

This order pre-funding and settlement process provides various benefits for financial institutions:

- Minimize counterparty risk as exchange account pre-funding is no longer required

- Minimize capital needs when using smart order routing across multiple exchange accounts

- Reduce execution latency incurred by on-chain transfers / deposits

- Full execution privacy as off-exchange allocations are not publicly visible on-chain

- Minimize network fees as only net balances are settled via on-chain transfers

Have a look at further details about the AlgoTrader custody integrations.

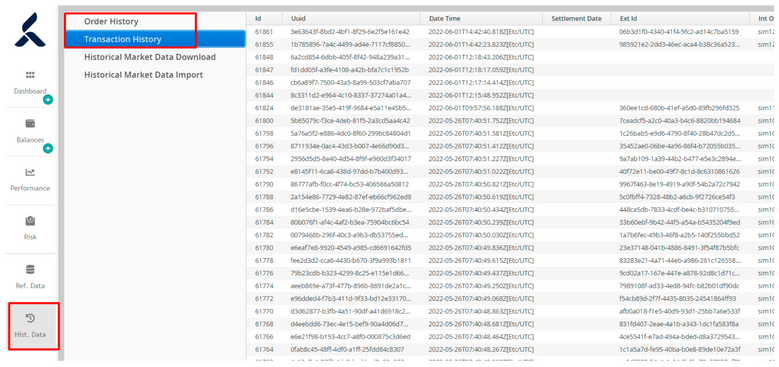

Order and transaction history

The Historical Data Dashboard now provides access to the entire order and transaction history, including the option to filter by date and time. This functionality is also available via the REST API.

Quantitative Trading

Backtest Report Extensions

Backtests are now able to store trade information and daily portfolio performance in InfluxDB. This improvement enables quants to compute their own metrics and generate their own custom reports.

A full list of the AlgoTrader quant trading capabilities can be found here.